There is a new running joke in Hong Kong: locals mock their city for losing its status as the darling of global capital. As one joked, it is the newest Unesco world heritage site. A tough security law - Article 23 - that came into effect over the weekend has only renewed the underlying concerns. Authorities say it will protect the city and ensure stability, while critics are alarmed it will silence all dissent with its closed-door trials and life sentences for broadly-defined offences - from insurrection to treason. It comes at a time when Beijing's iron grip and US-China tensions were already driving away foreign investors who now have an "anywhere but China" policy, says Mr Chan, a real estate surveyor, who did not wish to disclose his full name. "Hong Kong was seen as distinct from China so investors could still invest here - not anymore now," he says.

Article 23 and after

The emphasis on national security and the danger posed by "foreign forces" - a running theme in the legislation and in Beijing's recent policies - raises the stakes for foreign capital and businesses operating in the city.

"The business has been awful in the past two years and there was no major deal at all," says Mr Tse, who works for a Chinese state-owned bank. He said his company fired 10% of their staff in June and another 5% just this past week. "No one knows when it will be their turn."

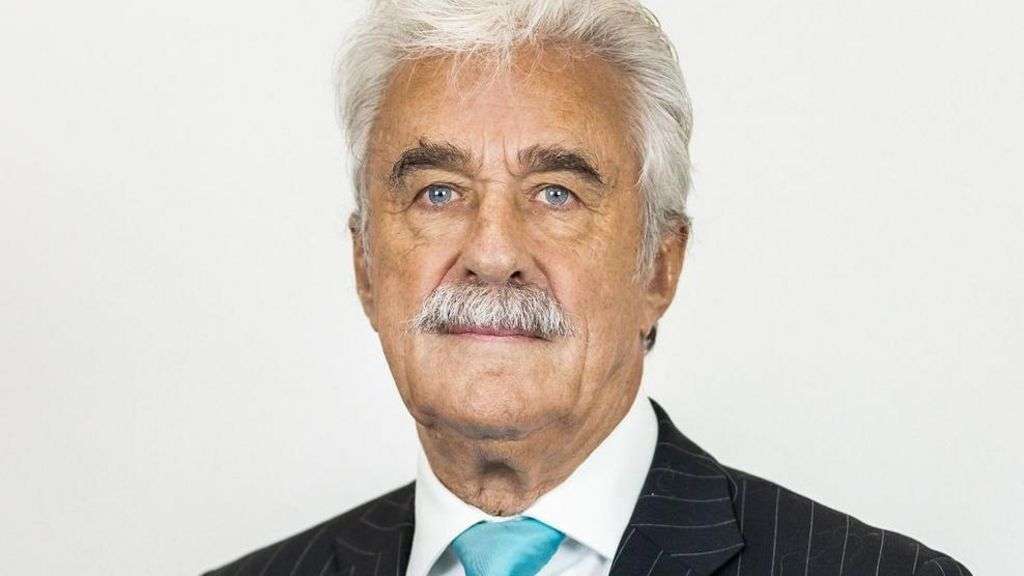

While it is too early to evaluate the risks of Article 23 to businesses, it could lead to higher compliance costs because of its "broad wording" and the "severe consequences of a breach", says Johannes Hack, the president of the German Chamber of Commerce.

The Hong Kong government told the OceanNewsUK in a statement that Article 23 will make the city "advance from stability to prosperity", and will not affect "normal" businesses. It also said it is "outrageous" to single out Hong Kong when other countries have security laws too.

Hong Kong's Article 23, which expands on national security legislation imposed by China in 2020, comes at a time when the city's administration is trying to reassure the world that it's still a financial dynamo.

The Hong Kong General Chamber of Commerce argued it "will make Hong Kong a safer destination for local and foreign businesses and professionals operating" in the city, while Hong Kong's chief executive John Lee had dismissed as "ridiculous" the notion that the administration only cared about national security, calling such concerns a form of "soft resistance".

Hong Kong's economy has been reeling from Beijing's crackdown since the pro-democracy protests in 2019 and a harsh zero-Covid policy. Rentals for commercial and retail spaces have fallen, leaving office buildings and shopfronts vacant. There are fewer tourists - last year's arrivals were only 60% of the pre-pandemic figure.

The value of the Hang Seng index - Hong Kong's crown jewel - has fallen by more than 40% since 2019. India overtook the city in January to become the world's fourth-largest stock market. Singapore has emerged as a stiff regional rival for finance. Global banks have been laying off people focused on Hong Kong and China, pointing to sluggish growth and plummeting investor confidence.

An exodus of capital and people has followed, with the former head of Morgan Stanley Asia declaring recently in a newspaper column that "Hong Kong is over". Veteran investor Lam Yat-ming wrote in an economic magazine that investors should "cherish their lives and distance themselves from Hong Kong stocks".

"Outside perception of Hong Kong" has changed, Mr Hack says.

"While the city is still distinctly different from the mainland, the focus on security may increasingly blur the distinction in people's minds."

One country, two systems

The former British colony has been run under the principle of "one country, two systems" since its return to China in 1997. Beijing promised that Hong Kong would enjoy civil liberties for half a century.

But critics say it has reneged on the deal, crushing pro-democracy protests and imposing a national security law (NSL) in 2020 under which more than 260 people, including former lawmakers, have been arrested. Authorities defend it, saying it marked the transition from "chaos to governance".

A local security law, outlined in the city's mini constitution, was always on the cards. The first attempt in 2003 failed after half a million people took to the streets against it. This time, Article 23 was passed less than two weeks after it was tabled.

Under Xi Jinping, China attaches "absolute importance" to national security - and Hong Kong's status as a free society and an international gateway comes second, says Kenneth Chan, a political scientist at Hong Kong Baptist University.

He says the arrest of Jimmy Lai, the former media mogul who has been charged under the NSL, was an "awakening for the international community".

"The national security law has no limits. Personal safety, private property rights, and individual assets are not guaranteed," Dr Chan adds.

After police raided Mr Lai's Apple Daily newspaper in 2021, trading in his company was suspended and it was delisted the following year. The 76-year-old tycoon, who is now on trial, has been behind bars for three years and his assets worth HK$500 million ($64m; £50m) have been frozen.

Hong Kong's common law system, which underpins its rule of law, has come under scrutiny following the trials of pro-democracy protesters. But the city's judiciary is perceived as independent, at least over commercial matters, although critics worry that Mr Lee can now pick judges handling national security cases.

Under such security laws, businesses in Hong Kong have to adopt additional measures to mitigate political risk - just like in the mainland, Dr Chan says.

"No-one can grasp the political direction, so big companies have started recruiting political consultants to evaluate risks and build political connections. These are all new costs, leading to lower efficiency."

To invest or not

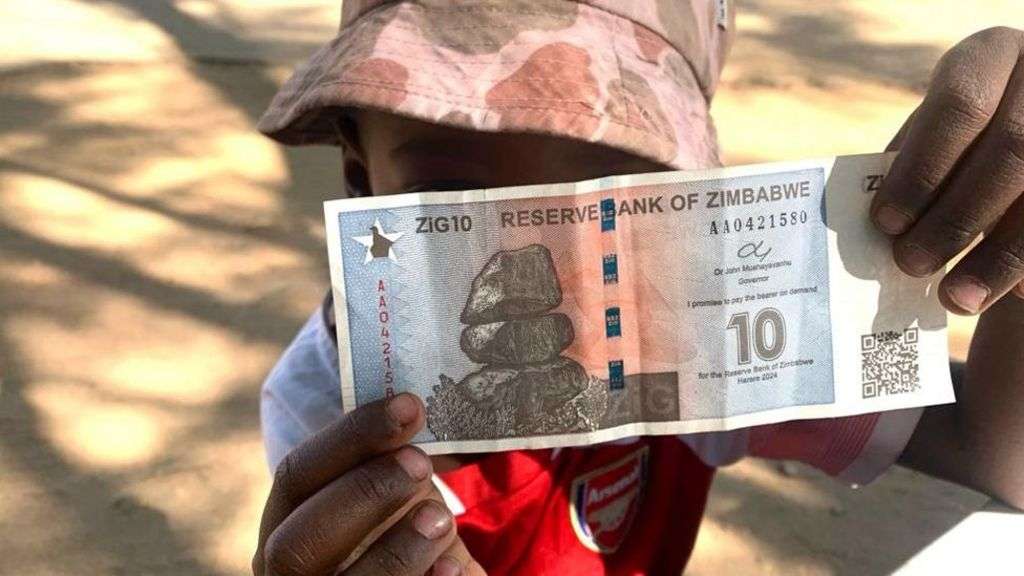

The city should not be discounted as an international financial hub, says Kevin Tsui, chief economist at the research firm Orientis. He adds that Hong Kong should make use of its advantages - a simple, low-rate tax system, and the fact that it's the only Chinese city with no foreign exchange controls. The Hong Kong dollar is also pegged to the US dollar, providing financial stability.

"Even if Hong Kong is just a Chinese city, foreigners want to do business with China," he says.

And yet confidence in the city has been shaken, not least because it is also feeling the heat of a slowing Chinese economy, which has been hit by debt and a property market crisis.

The mainland is the city's biggest trading partner and second-largest source of investment. Half of the 2,600 companies listed on Hong Kong's stock market are from mainland China.

But a new rule Beijing introduced last year requires Chinese companies to have official approval to list overseas. This has made the process far more cumbersome, said a banker who spoke on the condition of anonymity.

"We can only wait because we have no idea about the progress. If the companies are involved in sensitive industries such as data security or genetic technology, the process will be extremely slow," he said.

Hong Kong, which ranked as the world's number one IPO venue in seven of the last 15 years, is now in the eighth spot, according to industry reports.

"Beijing wants private companies to raise funds internationally to salvage the economy, but at the same time it worries these companies will no longer be under [their] control after listing," says the banker who wanted to remain anonymous.

"They want to control everything, but it will kill the financial market eventually."